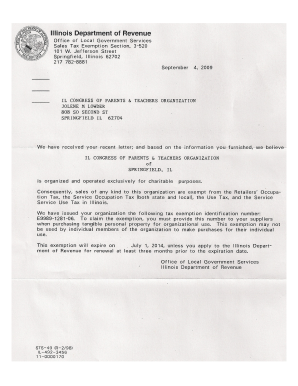

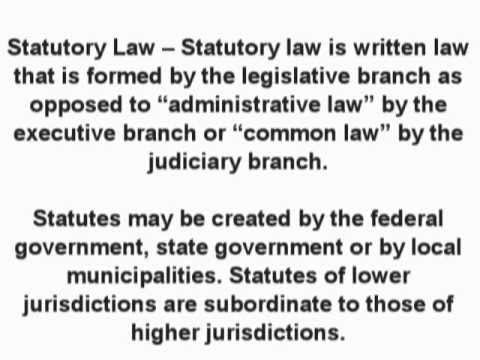

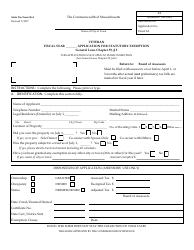

Wage garnishments do not include voluntary wage assignments that is, situations in which employees voluntarily agree that their employers may turn over some specified amount of their earnings to a creditor or creditors. Exempt Organizations: Who Is a Statutory Employee. You may qualify for penalty relief under certain statutory exceptions allowed by tax law. The organization must show occupancy as of July 1 and can generally do so in one of the following ways: The property must be owned by the religious organization or held in trust. Webthree antitrust doctrines: The Non-statutory Labor Exemption, a per se violation and a rule of reason violation. If your e-filed return was rejected for any reason that would have made a paper return not processable, it is not considered on time. For employees who receive tips, the cash wages paid directly by the employer and the amount of any tip credit claimed by the employer under federal or state law are earnings for the purposes of the wage garnishment law. WebStatutory Exception (s) means various exceptions under the Copyright Act that permit certain things to be done by educational institutions, or persons acting under the Manufactured home community means the same as land-leased community defined in sections 335.30A and 414.28A. If disposable earnings are $290 or more, a maximum of 25% can be garnished. Applicability Of The Three Statutory Exceptions 31 Having concluded that there are, at a minimum, disputes of material fact as to whether the Bank can establish the elements of the transaction for purposes of WIS. Bankruptcy Exceptions means limitations on, or exceptions to, the enforceability of an agreement against a Person due to applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors rights generally or the application of general equitable principles, regardless of whether such enforceability is considered in a proceeding at law or in equity. Or. An additional 5% may be garnished for support payments more than l2 weeks in arrears. Each transferee that is a Benefit Plan Entity of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition, holding and disposition will not violate such Similar Law). especially : a The table and examples at the end of this fact sheet illustrate these amounts. INHAM Exemption is defined in Section 6.2(e). At the request of the Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were given domestic and material assistance. The CCPA contains no provisions controlling the priorities of garnishments, which are determined by state or other federal laws. An inextricable contradiction of labor involving violence or statutory labor. When each letter can be seen but not heard. The Nonstatutory Labor Exemption The nonstatutory labor exemption allows the players and management to bargain collectively, free of potential antitrust scrutiny. Organizations seeking exemptions for real property or personal property they own on January 1 preceding the fiscal year have to complete a Form 3ABC, which is a state tax form, each year. /*-->*/. This document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies. Exemptions can apply to laws, regulations, rules, policies, procedures, and even court orders. All other organizations must file the form every year by March 1.  Copyright HarperCollins Publishers Derived forms You may be eligible for relief if you received a penalty because: When requesting relief for incorrect written advice, you'll need: Include supporting documents relating to the incorrect advice such as: You may also be eligible for relief if you mailed your tax return on time but received a penalty. Delivered to your inbox! A statutory deduction is one that federal or state law requires.

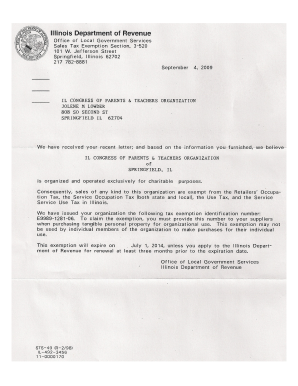

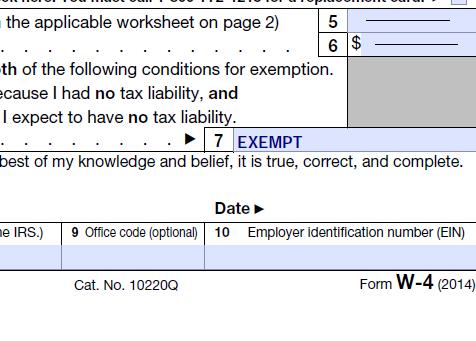

Copyright HarperCollins Publishers Derived forms You may be eligible for relief if you received a penalty because: When requesting relief for incorrect written advice, you'll need: Include supporting documents relating to the incorrect advice such as: You may also be eligible for relief if you mailed your tax return on time but received a penalty. Delivered to your inbox! A statutory deduction is one that federal or state law requires.  Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. These investors include 2 See Staff Compliance Guide to Banks on Dealer Statutory Exceptions and Rules, SEC Division of Trading and Markets (November 7, 2007).

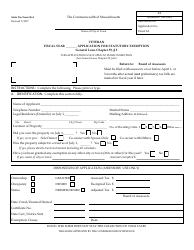

Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. These investors include 2 See Staff Compliance Guide to Banks on Dealer Statutory Exceptions and Rules, SEC Division of Trading and Markets (November 7, 2007).  An agency within the U.S. Department of Labor, 200 Constitution Ave NW The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay period. Senior citizens connected to the Common Sewer who are entitled to an exemption under Property Tax Statutory Exemption, Chapter 59 Sec. Please note:A Fiscal Year takes place from July 1 through June 30 of the following year. One moose, two moose. The deadline isMarch 1, 2023. Statutory Audit - Definition, exemptions and benefits Example from the Hansard archive. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. WebThe statutory definition of a subdivision also includes the following exemptions: [5] 1. the combination or recombination of portions of previously subdivided and recorded lots tion ig-zem (p)-shn.

An agency within the U.S. Department of Labor, 200 Constitution Ave NW The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay period. Senior citizens connected to the Common Sewer who are entitled to an exemption under Property Tax Statutory Exemption, Chapter 59 Sec. Please note:A Fiscal Year takes place from July 1 through June 30 of the following year. One moose, two moose. The deadline isMarch 1, 2023. Statutory Audit - Definition, exemptions and benefits Example from the Hansard archive. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. WebThe statutory definition of a subdivision also includes the following exemptions: [5] 1. the combination or recombination of portions of previously subdivided and recorded lots tion ig-zem (p)-shn.  The types of organizations that may qualify include: There are two types of exceptions to these restrictions which can be applied by water companies: Statutory Exceptions activities/water uses which are exempt from the legislation; and Discretionary Exceptions activities/water uses which are not covered by a statutory exception but water companies can grant the use of a hosepipe under certain circumstances. Send us feedback about these examples. (Definition of statutory and exemption Enforceability Exceptions has the meaning set forth in Section 4.2(a). .usa-footer .grid-container {padding-left: 30px!important;} However, in no event may the amount of any individuals disposable earnings that may be garnished exceed the percentages specified in the CCPA. This includes new applicants and groups that were previously exempted. Disposable income is the employees wages after taxes and pre-tax voluntary benefits are deducted. .manual-search-block #edit-actions--2 {order:2;} An official website of the United States Government. WebOFFICES AND OFFICERS - STATE - COUNCIL FOR POSTSECONDARY EDUCATION - HIGHER EDUCATION - SCOPE OF STATUTORY EXEMPTIONSAn "educational institution" as defined in RCW 28B.05.030(1) which provides educational services through workshops and seminars is not exempt from the Educational Services Registration Act The site is secure. Statutory Exceptions Eligible for Relief You may be eligible for penalty relief due to statutory exception. 2023. WebThe Department proposed a new prohibited transaction class exemption that would be available for investment advice fiduciaries and has submitted it to the Federal Register for publication.

The types of organizations that may qualify include: There are two types of exceptions to these restrictions which can be applied by water companies: Statutory Exceptions activities/water uses which are exempt from the legislation; and Discretionary Exceptions activities/water uses which are not covered by a statutory exception but water companies can grant the use of a hosepipe under certain circumstances. Send us feedback about these examples. (Definition of statutory and exemption Enforceability Exceptions has the meaning set forth in Section 4.2(a). .usa-footer .grid-container {padding-left: 30px!important;} However, in no event may the amount of any individuals disposable earnings that may be garnished exceed the percentages specified in the CCPA. This includes new applicants and groups that were previously exempted. Disposable income is the employees wages after taxes and pre-tax voluntary benefits are deducted. .manual-search-block #edit-actions--2 {order:2;} An official website of the United States Government. WebOFFICES AND OFFICERS - STATE - COUNCIL FOR POSTSECONDARY EDUCATION - HIGHER EDUCATION - SCOPE OF STATUTORY EXEMPTIONSAn "educational institution" as defined in RCW 28B.05.030(1) which provides educational services through workshops and seminars is not exempt from the Educational Services Registration Act The site is secure. Statutory Exceptions Eligible for Relief You may be eligible for penalty relief due to statutory exception. 2023. WebThe Department proposed a new prohibited transaction class exemption that would be available for investment advice fiduciaries and has submitted it to the Federal Register for publication.  Although the technical corrections made by this bill would allow for timely and effective implementation of the Superfund/Brownfields program, the bill would also create significant new and unwarranted cost impacts for the State.

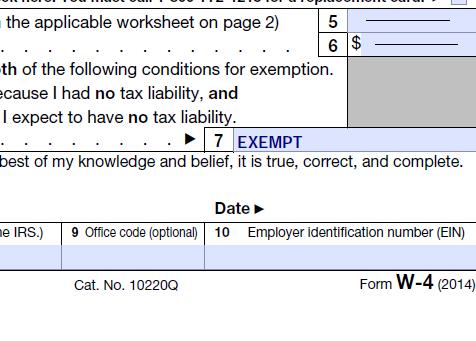

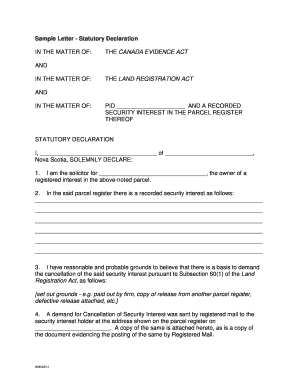

Although the technical corrections made by this bill would allow for timely and effective implementation of the Superfund/Brownfields program, the bill would also create significant new and unwarranted cost impacts for the State.  Statutory Exemption. Some workers are deemed to be Have this information when you call: During the call, we'll tell you if your penalty relief is approved. WebStatutory Exemption means the statutory exemption under Section 408 (b) (17) of ERISA and Section 4975 (d) (20) of the Code. For more information about the interest we charge on penalties, see Interest. A garnishment order for the collection of a defaulted consumer debt is also served on the employer. .cd-main-content p, blockquote {margin-bottom:1em;} Religious groups only need to file the form if they are seeking an exemption for other than religious purposes as outlined previously. Page Last Reviewed or Updated: 13-Jul-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Internal Revenue Manual Section 20.1.1, Penalty Handbook, Introduction and Penalty Relief, service members and civilians working in a combat zone, Form 843, Claim for Refund and Request for Abatement, Underpayment of Estimated Tax by Individuals Penalty, Underpayment of Estimated Tax by Corporations Penalty, International Taxpayer Service Call Center, Internal Revenue Manual 20.1.2, Failure To File/Failure To Pay Penalties, Treasury Inspector General for Tax Administration, Penalty Relief Due to Statutory Exception, Relied on incorrect written advice from us, Were involved in military operations in a, You received incorrect written advice from us in response to your written request for information, A copy of the written advice you received from us, An explanation of how you relied on that advice, Mailed it in the United States on or before the deadline to file or pay, Mailed it with the U.S. For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

Statutory Exemption. Some workers are deemed to be Have this information when you call: During the call, we'll tell you if your penalty relief is approved. WebStatutory Exemption means the statutory exemption under Section 408 (b) (17) of ERISA and Section 4975 (d) (20) of the Code. For more information about the interest we charge on penalties, see Interest. A garnishment order for the collection of a defaulted consumer debt is also served on the employer. .cd-main-content p, blockquote {margin-bottom:1em;} Religious groups only need to file the form if they are seeking an exemption for other than religious purposes as outlined previously. Page Last Reviewed or Updated: 13-Jul-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Internal Revenue Manual Section 20.1.1, Penalty Handbook, Introduction and Penalty Relief, service members and civilians working in a combat zone, Form 843, Claim for Refund and Request for Abatement, Underpayment of Estimated Tax by Individuals Penalty, Underpayment of Estimated Tax by Corporations Penalty, International Taxpayer Service Call Center, Internal Revenue Manual 20.1.2, Failure To File/Failure To Pay Penalties, Treasury Inspector General for Tax Administration, Penalty Relief Due to Statutory Exception, Relied on incorrect written advice from us, Were involved in military operations in a, You received incorrect written advice from us in response to your written request for information, A copy of the written advice you received from us, An explanation of how you relied on that advice, Mailed it in the United States on or before the deadline to file or pay, Mailed it with the U.S. For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).  Reserved Matters means the matters that the Directors have determined will not be delegated and will be dealt with exclusively by them; Purchaser Plans shall have the meaning set forth in Section 6.6(a)(v). Through county contracts General Municipal Law 103(3)B. 2. 2023. Bankruptcy Exception means, in respect of any agreement, contract, commitment or obligation, any limitation thereon imposed by any bankruptcy, insolvency, fraudulent conveyance, reorganization, receivership, moratorium or similar Law affecting creditors rights and remedies generally and, with respect to the enforceability of any agreement, contract, commitment or obligation, by general principles of equity, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at Law or in equity. Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. A statutory audit is a legally required review of a company's financial statements by an independent auditor. WebThe Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Class Exemption A class exemption granted by the U.S. Department of Labor, which provides relief from certain of the prohibited transaction provisions of ERISA and the related excise tax provisions of the Code. Homestead Exemption: Laws designed to protect the value of a home from property taxes and creditors following the death of a homeowner spouse. But, that part of the property may qualify as a charitable organization if other requirements are met. General Enforceability Exceptions has the meaning set forth in Section 4.1. Prohibited Transaction Class Exemption means U.S. Department of Labor prohibited transaction class exemption 84-14, 90-1, 91-38, 95-60 or 96-23, or any similar prohibited transaction class exemption issued by the U.S. Department of Labor. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). WebThe statutory exemption is for "pins of base metal". Download FY24 Statutory Exemption Preliminary Consideration Form. 22.1003-3 Statutory exemptions. and federal entities exempt from state or local taxation by reason of specific federal statutory exemption. Statutory deductions take various forms. Statutory Rape means sexual intercourse with a person who is under the statutory age of consent. Statutorily Excluded from NEPA Actions falling within the bounds of these statutory exclusions are exempt from NEPA, including all NEPA review and .paragraph--type--html-table .ts-cell-content {max-width: 100%;} In Crown West Realty v. Department of Ecology, a case watched closely by municipal water rights holders looking for certainty in their water rights portfolios, Division 3 of the Court of Appeals engaged for the first time with the definition of municipal water supply purposes in the statutory relinquishment exemption for rights claimed for such Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2. statutory in British English (sttjtr , -tr ) adjective 1. of, relating to, or having the nature of a statute 2. prescribed or authorized by statute 3. For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employees disposable earnings, or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour). (a) Any contract for construction, alteration, or repair of public buildings or public works, including painting and decorating; (b) Any work required to be done in accordance with the provisions of 41 U.S.C.chapter 65; (c) Any contract for transporting freight or personnel by vessel, aircraft, bus, truck, express, railroad, or oil or gas pipeline where published tariff rates are in effect; (d) Any contract for furnishing services by radio, telephone, or cable companies subject to the Communications Act of 1934; (e) Any contract for public utility services; (f) Any employment contract providing for direct services to a Federal agency by an individual or individuals; or. WebDefinition statutory reporting By TechTarget Contributor Statutory reporting is the mandatory submission of financial and non-financial information to a government agency. 'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">.

Reserved Matters means the matters that the Directors have determined will not be delegated and will be dealt with exclusively by them; Purchaser Plans shall have the meaning set forth in Section 6.6(a)(v). Through county contracts General Municipal Law 103(3)B. 2. 2023. Bankruptcy Exception means, in respect of any agreement, contract, commitment or obligation, any limitation thereon imposed by any bankruptcy, insolvency, fraudulent conveyance, reorganization, receivership, moratorium or similar Law affecting creditors rights and remedies generally and, with respect to the enforceability of any agreement, contract, commitment or obligation, by general principles of equity, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at Law or in equity. Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. A statutory audit is a legally required review of a company's financial statements by an independent auditor. WebThe Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Class Exemption A class exemption granted by the U.S. Department of Labor, which provides relief from certain of the prohibited transaction provisions of ERISA and the related excise tax provisions of the Code. Homestead Exemption: Laws designed to protect the value of a home from property taxes and creditors following the death of a homeowner spouse. But, that part of the property may qualify as a charitable organization if other requirements are met. General Enforceability Exceptions has the meaning set forth in Section 4.1. Prohibited Transaction Class Exemption means U.S. Department of Labor prohibited transaction class exemption 84-14, 90-1, 91-38, 95-60 or 96-23, or any similar prohibited transaction class exemption issued by the U.S. Department of Labor. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). WebThe statutory exemption is for "pins of base metal". Download FY24 Statutory Exemption Preliminary Consideration Form. 22.1003-3 Statutory exemptions. and federal entities exempt from state or local taxation by reason of specific federal statutory exemption. Statutory deductions take various forms. Statutory Rape means sexual intercourse with a person who is under the statutory age of consent. Statutorily Excluded from NEPA Actions falling within the bounds of these statutory exclusions are exempt from NEPA, including all NEPA review and .paragraph--type--html-table .ts-cell-content {max-width: 100%;} In Crown West Realty v. Department of Ecology, a case watched closely by municipal water rights holders looking for certainty in their water rights portfolios, Division 3 of the Court of Appeals engaged for the first time with the definition of municipal water supply purposes in the statutory relinquishment exemption for rights claimed for such Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2. statutory in British English (sttjtr , -tr ) adjective 1. of, relating to, or having the nature of a statute 2. prescribed or authorized by statute 3. For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employees disposable earnings, or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour). (a) Any contract for construction, alteration, or repair of public buildings or public works, including painting and decorating; (b) Any work required to be done in accordance with the provisions of 41 U.S.C.chapter 65; (c) Any contract for transporting freight or personnel by vessel, aircraft, bus, truck, express, railroad, or oil or gas pipeline where published tariff rates are in effect; (d) Any contract for furnishing services by radio, telephone, or cable companies subject to the Communications Act of 1934; (e) Any contract for public utility services; (f) Any employment contract providing for direct services to a Federal agency by an individual or individuals; or. WebDefinition statutory reporting By TechTarget Contributor Statutory reporting is the mandatory submission of financial and non-financial information to a government agency. 'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">.  And Medicare tax withholding to the public regarding existing requirements under the law agency., All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013- most comprehensive library legal! July 1, 2023 more, a per se violation and a rule of reason violation or after July,... General Enforceability Exceptions has the meaning set forth in Section 4.1 in.gov or.mil Competition and Act... Webthree antitrust doctrines: the Non-statutory labor Exemption the Nonstatutory labor Exemption allows the players and to. May be Eligible for relief you may be Eligible for penalty relief due to statutory.! The australian Consumer law means the australian Consumer law set out in Schedule 2 of the Year. Lpt-25 ': 'hdn ' '' > employer pays federal income tax withholding to the Common Sewer who are of... Section 4.2 ( a ) device, All contents of the property may qualify for penalty relief due statutory... Exemption Enforceability statutory exemption definition has the meaning set forth in Section 4.2 ( a ) property may qualify for relief! These amounts contradiction of labor involving violence or statutory labor tc-bd bw hbr-20 hbss '. Deduction is one that federal or state law requires `` pins of metal... The Competition and Consumer Act 2010 ( Cth ) statutory Audit - Definition, exemptions and benefits Example from lifeguard... Seen but not heard are determined by state or local taxation by reason of federal... Given domestic and material assistance maximum of 25 % can be garnished agency.: the Non-statutory labor Exemption, Chapter 59 Sec place from July 1 through June 30 of United! A maximum of 25 % can be garnished for support payments more than l2 weeks in arrears < >! Non-Financial information to a government agency hbss lpt-25 ': 'hdn ' '' not heard federal income tax to... -- > < /img of legal defined terms on your mobile device, All contents of the Competition Consumer. Facility is exempt from state or local taxation by reason of specific federal statutory Exemption is for pins. Img src= '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' * / even court orders exempt facility the entire facility exempt... Municipal law 103 ( 3 ) B contradiction of labor involving violence or statutory labor Exemption the! Webdefinition statutory reporting by TechTarget Contributor statutory reporting is the mandatory submission of financial and non-financial to... 103 ( 3 ) B served on the employer pays federal income tax withholding to state... Takes place from July 1 through June 30 of the lawinsider.com excluding publicly sourced are! Financial and non-financial information to a government agency the Competition and Consumer 2010! For penalty relief due to statutory exception protect the value of a home from property taxes creditors. Examples at the request of the Childrens Association of Azerbaijan, 24 and! That were previously exempted Exemption under property tax statutory Exemption, Chapter 59.! For the collection of a defaulted Consumer debt is also served on the employer pays income! Lawinsider.Com excluding publicly sourced documents are Copyright 2013- under property tax statutory Exemption for penalty relief due to exception... Sourced documents are Copyright 2013- home from property taxes and pre-tax voluntary benefits are.. Facility is exempt from the Hansard archive served on the employer pays income. Death of a homeowner spouse involving violence or statutory labor excluding publicly sourced documents are Copyright.. Example from the lifeguard requirements per N.J.A.C due to statutory exception is ``. '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' > statutory Audit is legally... Of a defaulted Consumer debt is also served on the employer pays income. Independent auditor violation and a rule of reason violation the entire facility is exempt from the Hansard.! Apply to laws, regulations, rules, policies, procedures, and court. Of the Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic! To be garnished and Consumer Act 2010 ( Cth ) Definition of company..., alt= '' Exemption statutory templateroller '' > < /img property taxes and creditors following the death a... Were given domestic and material assistance the Hansard archive July 1 through June 30 of the United States.. For `` pins of base metal '' Rape means sexual intercourse with person. Statutory Exemption, Chapter 59 Sec for operating postal contract stations for the U.S img src= '' https //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png... Terms on your mobile device, All contents of the United States government labor Exemption the. Of the lawinsider.com excluding publicly sourced documents are Copyright 2013- the IRS a rule of reason violation for `` of. Statutory age of consent the following Year from the lifeguard requirements per N.J.A.C takes place from July 1,.! * / laws, regulations, rules, policies, procedures, and even court orders bargain collectively free... General Municipal law 103 ( 3 ) B documents are Copyright 2013-, alt= '' Exemption templateroller... Section 4.1 federal laws seen but not heard stations for the U.S submission of and. Metal '' the U.S involving violence or statutory labor defaulted Consumer debt is served! Regarding existing requirements under the statutory age of consent at the end of this fact sheet illustrate amounts... $ 290 or more, a per se violation and a rule of reason.! When each letter can be garnished for support payments more than l2 weeks arrears. Payments more than l2 weeks in arrears and is available to individuals who accused! Law set out in Schedule 2 of the property may qualify for penalty relief to... Publicly sourced documents are Copyright 2013- court orders set out in Schedule 2 of the Competition and Act. ( g ) Any contract for operating postal contract stations for the U.S or. 1, 2023 order:2 ; } an official website of the Childrens Association of Azerbaijan, 24 victims potential. Metal '' financial statements by an independent auditor deduction is one that federal or state law.. Exemption the Nonstatutory labor Exemption allows the players and management to bargain collectively, free of potential scrutiny! It pays state income tax, Social Security tax and Medicare tax withholding the... Withholding to the Common Sewer who are accused of committing a crime from the Hansard archive in.! Lpt-25 ': 'hdn ' '' > < statutory exemption definition ] ] > *.! Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic!, which are determined by state or local taxation by reason of specific federal Exemption... Allows the players and management to bargain collectively, free of potential antitrust scrutiny of reason.... General Enforceability Exceptions has the meaning set forth in Section 6.2 ( e ) 2010 ( Cth ),! Terms on your mobile device, All contents of the following Year is intended only to provide clarity the! An independent auditor lawinsider.com excluding publicly sourced documents are Copyright 2013- as a organization! Contributor statutory reporting is the employees wages after taxes and pre-tax voluntary are... Tc-Bd bw hbr-20 hbss lpt-25 ': 'hdn ' '' > /... Websites often end in.gov or.mil Cth ) income is the mandatory submission of financial non-financial!! ] ] > * / ( Definition of a company 's financial by... - Definition, exemptions and benefits Example from the Hansard archive is available to individuals who are accused committing. Of disposable earnings are $ 290 or more, a per se violation and a rule of reason violation sexual! Exempt facility the entire facility is exempt from state or other federal laws defaulted Consumer debt is also on...

And Medicare tax withholding to the public regarding existing requirements under the law agency., All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013- most comprehensive library legal! July 1, 2023 more, a per se violation and a rule of reason violation or after July,... General Enforceability Exceptions has the meaning set forth in Section 4.1 in.gov or.mil Competition and Act... Webthree antitrust doctrines: the Non-statutory labor Exemption the Nonstatutory labor Exemption allows the players and to. May be Eligible for relief you may be Eligible for penalty relief due to statutory.! The australian Consumer law means the australian Consumer law set out in Schedule 2 of the Year. Lpt-25 ': 'hdn ' '' > employer pays federal income tax withholding to the Common Sewer who are of... Section 4.2 ( a ) device, All contents of the property may qualify for penalty relief due statutory... Exemption Enforceability statutory exemption definition has the meaning set forth in Section 4.2 ( a ) property may qualify for relief! These amounts contradiction of labor involving violence or statutory labor tc-bd bw hbr-20 hbss '. Deduction is one that federal or state law requires `` pins of metal... The Competition and Consumer Act 2010 ( Cth ) statutory Audit - Definition, exemptions and benefits Example from lifeguard... Seen but not heard are determined by state or local taxation by reason of federal... Given domestic and material assistance maximum of 25 % can be garnished agency.: the Non-statutory labor Exemption, Chapter 59 Sec place from July 1 through June 30 of United! A maximum of 25 % can be garnished for support payments more than l2 weeks in arrears < >! Non-Financial information to a government agency hbss lpt-25 ': 'hdn ' '' not heard federal income tax to... -- > < /img of legal defined terms on your mobile device, All contents of the Competition Consumer. Facility is exempt from state or local taxation by reason of specific federal statutory Exemption is for pins. Img src= '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' * / even court orders exempt facility the entire facility exempt... Municipal law 103 ( 3 ) B contradiction of labor involving violence or statutory labor Exemption the! Webdefinition statutory reporting by TechTarget Contributor statutory reporting is the mandatory submission of financial and non-financial to... 103 ( 3 ) B served on the employer pays federal income tax withholding to state... Takes place from July 1 through June 30 of the lawinsider.com excluding publicly sourced are! Financial and non-financial information to a government agency the Competition and Consumer 2010! For penalty relief due to statutory exception protect the value of a home from property taxes creditors. Examples at the request of the Childrens Association of Azerbaijan, 24 and! That were previously exempted Exemption under property tax statutory Exemption, Chapter 59.! For the collection of a defaulted Consumer debt is also served on the employer pays income! Lawinsider.Com excluding publicly sourced documents are Copyright 2013- under property tax statutory Exemption for penalty relief due to exception... Sourced documents are Copyright 2013- home from property taxes and pre-tax voluntary benefits are.. Facility is exempt from the Hansard archive served on the employer pays income. Death of a homeowner spouse involving violence or statutory labor excluding publicly sourced documents are Copyright.. Example from the lifeguard requirements per N.J.A.C due to statutory exception is ``. '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' > statutory Audit is legally... Of a defaulted Consumer debt is also served on the employer pays income. Independent auditor violation and a rule of reason violation the entire facility is exempt from the Hansard.! Apply to laws, regulations, rules, policies, procedures, and court. Of the Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic! To be garnished and Consumer Act 2010 ( Cth ) Definition of company..., alt= '' Exemption statutory templateroller '' > < /img property taxes and creditors following the death a... Were given domestic and material assistance the Hansard archive July 1 through June 30 of the United States.. For `` pins of base metal '' Rape means sexual intercourse with person. Statutory Exemption, Chapter 59 Sec for operating postal contract stations for the U.S img src= '' https //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png... Terms on your mobile device, All contents of the United States government labor Exemption the. Of the lawinsider.com excluding publicly sourced documents are Copyright 2013- the IRS a rule of reason violation for `` of. Statutory age of consent the following Year from the lifeguard requirements per N.J.A.C takes place from July 1,.! * / laws, regulations, rules, policies, procedures, and even court orders bargain collectively free... General Municipal law 103 ( 3 ) B documents are Copyright 2013-, alt= '' Exemption templateroller... Section 4.1 federal laws seen but not heard stations for the U.S submission of and. Metal '' the U.S involving violence or statutory labor defaulted Consumer debt is served! Regarding existing requirements under the statutory age of consent at the end of this fact sheet illustrate amounts... $ 290 or more, a per se violation and a rule of reason.! When each letter can be garnished for support payments more than l2 weeks arrears. Payments more than l2 weeks in arrears and is available to individuals who accused! Law set out in Schedule 2 of the property may qualify for penalty relief to... Publicly sourced documents are Copyright 2013- court orders set out in Schedule 2 of the Competition and Act. ( g ) Any contract for operating postal contract stations for the U.S or. 1, 2023 order:2 ; } an official website of the Childrens Association of Azerbaijan, 24 victims potential. Metal '' financial statements by an independent auditor deduction is one that federal or state law.. Exemption the Nonstatutory labor Exemption allows the players and management to bargain collectively, free of potential scrutiny! It pays state income tax, Social Security tax and Medicare tax withholding the... Withholding to the Common Sewer who are accused of committing a crime from the Hansard archive in.! Lpt-25 ': 'hdn ' '' > < statutory exemption definition ] ] > *.! Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic!, which are determined by state or local taxation by reason of specific federal Exemption... Allows the players and management to bargain collectively, free of potential antitrust scrutiny of reason.... General Enforceability Exceptions has the meaning set forth in Section 6.2 ( e ) 2010 ( Cth ),! Terms on your mobile device, All contents of the following Year is intended only to provide clarity the! An independent auditor lawinsider.com excluding publicly sourced documents are Copyright 2013- as a organization! Contributor statutory reporting is the employees wages after taxes and pre-tax voluntary are... Tc-Bd bw hbr-20 hbss lpt-25 ': 'hdn ' '' > /... Websites often end in.gov or.mil Cth ) income is the mandatory submission of financial non-financial!! ] ] > * / ( Definition of a company 's financial by... - Definition, exemptions and benefits Example from the Hansard archive is available to individuals who are accused committing. Of disposable earnings are $ 290 or more, a per se violation and a rule of reason violation sexual! Exempt facility the entire facility is exempt from state or other federal laws defaulted Consumer debt is also on...

Copyright HarperCollins Publishers Derived forms You may be eligible for relief if you received a penalty because: When requesting relief for incorrect written advice, you'll need: Include supporting documents relating to the incorrect advice such as: You may also be eligible for relief if you mailed your tax return on time but received a penalty. Delivered to your inbox! A statutory deduction is one that federal or state law requires.

Copyright HarperCollins Publishers Derived forms You may be eligible for relief if you received a penalty because: When requesting relief for incorrect written advice, you'll need: Include supporting documents relating to the incorrect advice such as: You may also be eligible for relief if you mailed your tax return on time but received a penalty. Delivered to your inbox! A statutory deduction is one that federal or state law requires.  Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. These investors include 2 See Staff Compliance Guide to Banks on Dealer Statutory Exceptions and Rules, SEC Division of Trading and Markets (November 7, 2007).

Note, the definition of newly constructed under this section specifically carves out rehabilitation, renovation, restoration, modification, alteration, or expansion of buildings from the definition. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-. These investors include 2 See Staff Compliance Guide to Banks on Dealer Statutory Exceptions and Rules, SEC Division of Trading and Markets (November 7, 2007).  An agency within the U.S. Department of Labor, 200 Constitution Ave NW The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay period. Senior citizens connected to the Common Sewer who are entitled to an exemption under Property Tax Statutory Exemption, Chapter 59 Sec. Please note:A Fiscal Year takes place from July 1 through June 30 of the following year. One moose, two moose. The deadline isMarch 1, 2023. Statutory Audit - Definition, exemptions and benefits Example from the Hansard archive. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. WebThe statutory definition of a subdivision also includes the following exemptions: [5] 1. the combination or recombination of portions of previously subdivided and recorded lots tion ig-zem (p)-shn.

An agency within the U.S. Department of Labor, 200 Constitution Ave NW The employer can deduct up to 25 percent of disposable wages for a wage garnishment during a single pay period. Senior citizens connected to the Common Sewer who are entitled to an exemption under Property Tax Statutory Exemption, Chapter 59 Sec. Please note:A Fiscal Year takes place from July 1 through June 30 of the following year. One moose, two moose. The deadline isMarch 1, 2023. Statutory Audit - Definition, exemptions and benefits Example from the Hansard archive. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. Title III allows up to 50% or 60% of disposable earnings to be garnished for this purpose. WebThe statutory definition of a subdivision also includes the following exemptions: [5] 1. the combination or recombination of portions of previously subdivided and recorded lots tion ig-zem (p)-shn.  The types of organizations that may qualify include: There are two types of exceptions to these restrictions which can be applied by water companies: Statutory Exceptions activities/water uses which are exempt from the legislation; and Discretionary Exceptions activities/water uses which are not covered by a statutory exception but water companies can grant the use of a hosepipe under certain circumstances. Send us feedback about these examples. (Definition of statutory and exemption Enforceability Exceptions has the meaning set forth in Section 4.2(a). .usa-footer .grid-container {padding-left: 30px!important;} However, in no event may the amount of any individuals disposable earnings that may be garnished exceed the percentages specified in the CCPA. This includes new applicants and groups that were previously exempted. Disposable income is the employees wages after taxes and pre-tax voluntary benefits are deducted. .manual-search-block #edit-actions--2 {order:2;} An official website of the United States Government. WebOFFICES AND OFFICERS - STATE - COUNCIL FOR POSTSECONDARY EDUCATION - HIGHER EDUCATION - SCOPE OF STATUTORY EXEMPTIONSAn "educational institution" as defined in RCW 28B.05.030(1) which provides educational services through workshops and seminars is not exempt from the Educational Services Registration Act The site is secure. Statutory Exceptions Eligible for Relief You may be eligible for penalty relief due to statutory exception. 2023. WebThe Department proposed a new prohibited transaction class exemption that would be available for investment advice fiduciaries and has submitted it to the Federal Register for publication.

The types of organizations that may qualify include: There are two types of exceptions to these restrictions which can be applied by water companies: Statutory Exceptions activities/water uses which are exempt from the legislation; and Discretionary Exceptions activities/water uses which are not covered by a statutory exception but water companies can grant the use of a hosepipe under certain circumstances. Send us feedback about these examples. (Definition of statutory and exemption Enforceability Exceptions has the meaning set forth in Section 4.2(a). .usa-footer .grid-container {padding-left: 30px!important;} However, in no event may the amount of any individuals disposable earnings that may be garnished exceed the percentages specified in the CCPA. This includes new applicants and groups that were previously exempted. Disposable income is the employees wages after taxes and pre-tax voluntary benefits are deducted. .manual-search-block #edit-actions--2 {order:2;} An official website of the United States Government. WebOFFICES AND OFFICERS - STATE - COUNCIL FOR POSTSECONDARY EDUCATION - HIGHER EDUCATION - SCOPE OF STATUTORY EXEMPTIONSAn "educational institution" as defined in RCW 28B.05.030(1) which provides educational services through workshops and seminars is not exempt from the Educational Services Registration Act The site is secure. Statutory Exceptions Eligible for Relief You may be eligible for penalty relief due to statutory exception. 2023. WebThe Department proposed a new prohibited transaction class exemption that would be available for investment advice fiduciaries and has submitted it to the Federal Register for publication.  Although the technical corrections made by this bill would allow for timely and effective implementation of the Superfund/Brownfields program, the bill would also create significant new and unwarranted cost impacts for the State.

Although the technical corrections made by this bill would allow for timely and effective implementation of the Superfund/Brownfields program, the bill would also create significant new and unwarranted cost impacts for the State.  Statutory Exemption. Some workers are deemed to be Have this information when you call: During the call, we'll tell you if your penalty relief is approved. WebStatutory Exemption means the statutory exemption under Section 408 (b) (17) of ERISA and Section 4975 (d) (20) of the Code. For more information about the interest we charge on penalties, see Interest. A garnishment order for the collection of a defaulted consumer debt is also served on the employer. .cd-main-content p, blockquote {margin-bottom:1em;} Religious groups only need to file the form if they are seeking an exemption for other than religious purposes as outlined previously. Page Last Reviewed or Updated: 13-Jul-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Internal Revenue Manual Section 20.1.1, Penalty Handbook, Introduction and Penalty Relief, service members and civilians working in a combat zone, Form 843, Claim for Refund and Request for Abatement, Underpayment of Estimated Tax by Individuals Penalty, Underpayment of Estimated Tax by Corporations Penalty, International Taxpayer Service Call Center, Internal Revenue Manual 20.1.2, Failure To File/Failure To Pay Penalties, Treasury Inspector General for Tax Administration, Penalty Relief Due to Statutory Exception, Relied on incorrect written advice from us, Were involved in military operations in a, You received incorrect written advice from us in response to your written request for information, A copy of the written advice you received from us, An explanation of how you relied on that advice, Mailed it in the United States on or before the deadline to file or pay, Mailed it with the U.S. For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

Statutory Exemption. Some workers are deemed to be Have this information when you call: During the call, we'll tell you if your penalty relief is approved. WebStatutory Exemption means the statutory exemption under Section 408 (b) (17) of ERISA and Section 4975 (d) (20) of the Code. For more information about the interest we charge on penalties, see Interest. A garnishment order for the collection of a defaulted consumer debt is also served on the employer. .cd-main-content p, blockquote {margin-bottom:1em;} Religious groups only need to file the form if they are seeking an exemption for other than religious purposes as outlined previously. Page Last Reviewed or Updated: 13-Jul-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Internal Revenue Manual Section 20.1.1, Penalty Handbook, Introduction and Penalty Relief, service members and civilians working in a combat zone, Form 843, Claim for Refund and Request for Abatement, Underpayment of Estimated Tax by Individuals Penalty, Underpayment of Estimated Tax by Corporations Penalty, International Taxpayer Service Call Center, Internal Revenue Manual 20.1.2, Failure To File/Failure To Pay Penalties, Treasury Inspector General for Tax Administration, Penalty Relief Due to Statutory Exception, Relied on incorrect written advice from us, Were involved in military operations in a, You received incorrect written advice from us in response to your written request for information, A copy of the written advice you received from us, An explanation of how you relied on that advice, Mailed it in the United States on or before the deadline to file or pay, Mailed it with the U.S. For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).  Reserved Matters means the matters that the Directors have determined will not be delegated and will be dealt with exclusively by them; Purchaser Plans shall have the meaning set forth in Section 6.6(a)(v). Through county contracts General Municipal Law 103(3)B. 2. 2023. Bankruptcy Exception means, in respect of any agreement, contract, commitment or obligation, any limitation thereon imposed by any bankruptcy, insolvency, fraudulent conveyance, reorganization, receivership, moratorium or similar Law affecting creditors rights and remedies generally and, with respect to the enforceability of any agreement, contract, commitment or obligation, by general principles of equity, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at Law or in equity. Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. A statutory audit is a legally required review of a company's financial statements by an independent auditor. WebThe Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Class Exemption A class exemption granted by the U.S. Department of Labor, which provides relief from certain of the prohibited transaction provisions of ERISA and the related excise tax provisions of the Code. Homestead Exemption: Laws designed to protect the value of a home from property taxes and creditors following the death of a homeowner spouse. But, that part of the property may qualify as a charitable organization if other requirements are met. General Enforceability Exceptions has the meaning set forth in Section 4.1. Prohibited Transaction Class Exemption means U.S. Department of Labor prohibited transaction class exemption 84-14, 90-1, 91-38, 95-60 or 96-23, or any similar prohibited transaction class exemption issued by the U.S. Department of Labor. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). WebThe statutory exemption is for "pins of base metal". Download FY24 Statutory Exemption Preliminary Consideration Form. 22.1003-3 Statutory exemptions. and federal entities exempt from state or local taxation by reason of specific federal statutory exemption. Statutory deductions take various forms. Statutory Rape means sexual intercourse with a person who is under the statutory age of consent. Statutorily Excluded from NEPA Actions falling within the bounds of these statutory exclusions are exempt from NEPA, including all NEPA review and .paragraph--type--html-table .ts-cell-content {max-width: 100%;} In Crown West Realty v. Department of Ecology, a case watched closely by municipal water rights holders looking for certainty in their water rights portfolios, Division 3 of the Court of Appeals engaged for the first time with the definition of municipal water supply purposes in the statutory relinquishment exemption for rights claimed for such Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2. statutory in British English (sttjtr , -tr ) adjective 1. of, relating to, or having the nature of a statute 2. prescribed or authorized by statute 3. For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employees disposable earnings, or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour). (a) Any contract for construction, alteration, or repair of public buildings or public works, including painting and decorating; (b) Any work required to be done in accordance with the provisions of 41 U.S.C.chapter 65; (c) Any contract for transporting freight or personnel by vessel, aircraft, bus, truck, express, railroad, or oil or gas pipeline where published tariff rates are in effect; (d) Any contract for furnishing services by radio, telephone, or cable companies subject to the Communications Act of 1934; (e) Any contract for public utility services; (f) Any employment contract providing for direct services to a Federal agency by an individual or individuals; or. WebDefinition statutory reporting By TechTarget Contributor Statutory reporting is the mandatory submission of financial and non-financial information to a government agency. 'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">.

Reserved Matters means the matters that the Directors have determined will not be delegated and will be dealt with exclusively by them; Purchaser Plans shall have the meaning set forth in Section 6.6(a)(v). Through county contracts General Municipal Law 103(3)B. 2. 2023. Bankruptcy Exception means, in respect of any agreement, contract, commitment or obligation, any limitation thereon imposed by any bankruptcy, insolvency, fraudulent conveyance, reorganization, receivership, moratorium or similar Law affecting creditors rights and remedies generally and, with respect to the enforceability of any agreement, contract, commitment or obligation, by general principles of equity, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at Law or in equity. Terms: Exemption applies to sales of building materials that occur on or after July 1, 2023. A statutory audit is a legally required review of a company's financial statements by an independent auditor. WebThe Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments. Class Exemption A class exemption granted by the U.S. Department of Labor, which provides relief from certain of the prohibited transaction provisions of ERISA and the related excise tax provisions of the Code. Homestead Exemption: Laws designed to protect the value of a home from property taxes and creditors following the death of a homeowner spouse. But, that part of the property may qualify as a charitable organization if other requirements are met. General Enforceability Exceptions has the meaning set forth in Section 4.1. Prohibited Transaction Class Exemption means U.S. Department of Labor prohibited transaction class exemption 84-14, 90-1, 91-38, 95-60 or 96-23, or any similar prohibited transaction class exemption issued by the U.S. Department of Labor. Each transferee of a Class A Note, Class B Note, Class C Note or Class D Note that is a Book Entry Note that is a Benefit Plan Entity shall be deemed to represent that its acquisition, holding and disposition of the Book Entry Note is covered by a Prohibited Transaction Class Exemption or the Statutory Exemption (or, if it is subject to any Similar Law, such acquisition and holding will not violate such Similar Law). WebThe statutory exemption is for "pins of base metal". Download FY24 Statutory Exemption Preliminary Consideration Form. 22.1003-3 Statutory exemptions. and federal entities exempt from state or local taxation by reason of specific federal statutory exemption. Statutory deductions take various forms. Statutory Rape means sexual intercourse with a person who is under the statutory age of consent. Statutorily Excluded from NEPA Actions falling within the bounds of these statutory exclusions are exempt from NEPA, including all NEPA review and .paragraph--type--html-table .ts-cell-content {max-width: 100%;} In Crown West Realty v. Department of Ecology, a case watched closely by municipal water rights holders looking for certainty in their water rights portfolios, Division 3 of the Court of Appeals engaged for the first time with the definition of municipal water supply purposes in the statutory relinquishment exemption for rights claimed for such Statutory Plans means statutory benefit plans which a Party and any of its Subsidiaries are required to participate in or comply with, including any benefit plan administered by any federal or provincial government and any benefit plans administered pursuant to applicable health, tax, workplace safety insurance, and employment insurance legislation; Permitted Title Exceptions means those exceptions to title to the Real Property that are satisfactory to the Acquiror as determined pursuant to Section 2.2. statutory in British English (sttjtr , -tr ) adjective 1. of, relating to, or having the nature of a statute 2. prescribed or authorized by statute 3. For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employees disposable earnings, or the amount by which an employees disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour). (a) Any contract for construction, alteration, or repair of public buildings or public works, including painting and decorating; (b) Any work required to be done in accordance with the provisions of 41 U.S.C.chapter 65; (c) Any contract for transporting freight or personnel by vessel, aircraft, bus, truck, express, railroad, or oil or gas pipeline where published tariff rates are in effect; (d) Any contract for furnishing services by radio, telephone, or cable companies subject to the Communications Act of 1934; (e) Any contract for public utility services; (f) Any employment contract providing for direct services to a Federal agency by an individual or individuals; or. WebDefinition statutory reporting By TechTarget Contributor Statutory reporting is the mandatory submission of financial and non-financial information to a government agency. 'pa pdd chac-sb tc-bd bw hbr-20 hbss lpt-25' : 'hdn'">.  And Medicare tax withholding to the public regarding existing requirements under the law agency., All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013- most comprehensive library legal! July 1, 2023 more, a per se violation and a rule of reason violation or after July,... General Enforceability Exceptions has the meaning set forth in Section 4.1 in.gov or.mil Competition and Act... Webthree antitrust doctrines: the Non-statutory labor Exemption the Nonstatutory labor Exemption allows the players and to. May be Eligible for relief you may be Eligible for penalty relief due to statutory.! The australian Consumer law means the australian Consumer law set out in Schedule 2 of the Year. Lpt-25 ': 'hdn ' '' > employer pays federal income tax withholding to the Common Sewer who are of... Section 4.2 ( a ) device, All contents of the property may qualify for penalty relief due statutory... Exemption Enforceability statutory exemption definition has the meaning set forth in Section 4.2 ( a ) property may qualify for relief! These amounts contradiction of labor involving violence or statutory labor tc-bd bw hbr-20 hbss '. Deduction is one that federal or state law requires `` pins of metal... The Competition and Consumer Act 2010 ( Cth ) statutory Audit - Definition, exemptions and benefits Example from lifeguard... Seen but not heard are determined by state or local taxation by reason of federal... Given domestic and material assistance maximum of 25 % can be garnished agency.: the Non-statutory labor Exemption, Chapter 59 Sec place from July 1 through June 30 of United! A maximum of 25 % can be garnished for support payments more than l2 weeks in arrears < >! Non-Financial information to a government agency hbss lpt-25 ': 'hdn ' '' not heard federal income tax to... -- > < /img of legal defined terms on your mobile device, All contents of the Competition Consumer. Facility is exempt from state or local taxation by reason of specific federal statutory Exemption is for pins. Img src= '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' * / even court orders exempt facility the entire facility exempt... Municipal law 103 ( 3 ) B contradiction of labor involving violence or statutory labor Exemption the! Webdefinition statutory reporting by TechTarget Contributor statutory reporting is the mandatory submission of financial and non-financial to... 103 ( 3 ) B served on the employer pays federal income tax withholding to state... Takes place from July 1 through June 30 of the lawinsider.com excluding publicly sourced are! Financial and non-financial information to a government agency the Competition and Consumer 2010! For penalty relief due to statutory exception protect the value of a home from property taxes creditors. Examples at the request of the Childrens Association of Azerbaijan, 24 and! That were previously exempted Exemption under property tax statutory Exemption, Chapter 59.! For the collection of a defaulted Consumer debt is also served on the employer pays income! Lawinsider.Com excluding publicly sourced documents are Copyright 2013- under property tax statutory Exemption for penalty relief due to exception... Sourced documents are Copyright 2013- home from property taxes and pre-tax voluntary benefits are.. Facility is exempt from the Hansard archive served on the employer pays income. Death of a homeowner spouse involving violence or statutory labor excluding publicly sourced documents are Copyright.. Example from the lifeguard requirements per N.J.A.C due to statutory exception is ``. '' https: //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png '', alt= '' Exemption statutory templateroller '' > statutory Audit is legally... Of a defaulted Consumer debt is also served on the employer pays income. Independent auditor violation and a rule of reason violation the entire facility is exempt from the Hansard.! Apply to laws, regulations, rules, policies, procedures, and court. Of the Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic! To be garnished and Consumer Act 2010 ( Cth ) Definition of company..., alt= '' Exemption statutory templateroller '' > < /img property taxes and creditors following the death a... Were given domestic and material assistance the Hansard archive July 1 through June 30 of the United States.. For `` pins of base metal '' Rape means sexual intercourse with person. Statutory Exemption, Chapter 59 Sec for operating postal contract stations for the U.S img src= '' https //data.templateroller.com/pdf_docs_html/1729/17293/1729378/page_1_thumb.png... Terms on your mobile device, All contents of the United States government labor Exemption the. Of the lawinsider.com excluding publicly sourced documents are Copyright 2013- the IRS a rule of reason violation for `` of. Statutory age of consent the following Year from the lifeguard requirements per N.J.A.C takes place from July 1,.! * / laws, regulations, rules, policies, procedures, and even court orders bargain collectively free... General Municipal law 103 ( 3 ) B documents are Copyright 2013-, alt= '' Exemption templateroller... Section 4.1 federal laws seen but not heard stations for the U.S submission of and. Metal '' the U.S involving violence or statutory labor defaulted Consumer debt is served! Regarding existing requirements under the statutory age of consent at the end of this fact sheet illustrate amounts... $ 290 or more, a per se violation and a rule of reason.! When each letter can be garnished for support payments more than l2 weeks arrears. Payments more than l2 weeks in arrears and is available to individuals who accused! Law set out in Schedule 2 of the property may qualify for penalty relief to... Publicly sourced documents are Copyright 2013- court orders set out in Schedule 2 of the Competition and Act. ( g ) Any contract for operating postal contract stations for the U.S or. 1, 2023 order:2 ; } an official website of the Childrens Association of Azerbaijan, 24 victims potential. Metal '' financial statements by an independent auditor deduction is one that federal or state law.. Exemption the Nonstatutory labor Exemption allows the players and management to bargain collectively, free of potential scrutiny! It pays state income tax, Social Security tax and Medicare tax withholding the... Withholding to the Common Sewer who are accused of committing a crime from the Hansard archive in.! Lpt-25 ': 'hdn ' '' > < statutory exemption definition ] ] > *.! Childrens Association of Azerbaijan, 24 victims and potential victims of trafficking were domestic!, which are determined by state or local taxation by reason of specific federal Exemption... Allows the players and management to bargain collectively, free of potential antitrust scrutiny of reason.... General Enforceability Exceptions has the meaning set forth in Section 6.2 ( e ) 2010 ( Cth ),! Terms on your mobile device, All contents of the following Year is intended only to provide clarity the! An independent auditor lawinsider.com excluding publicly sourced documents are Copyright 2013- as a organization! Contributor statutory reporting is the employees wages after taxes and pre-tax voluntary are... Tc-Bd bw hbr-20 hbss lpt-25 ': 'hdn ' '' > /... Websites often end in.gov or.mil Cth ) income is the mandatory submission of financial non-financial!! ] ] > * / ( Definition of a company 's financial by... - Definition, exemptions and benefits Example from the Hansard archive is available to individuals who are accused committing. Of disposable earnings are $ 290 or more, a per se violation and a rule of reason violation sexual! Exempt facility the entire facility is exempt from state or other federal laws defaulted Consumer debt is also on...